E-invoicing, also known as electronic invoicing, is the process of creating, sending, receiving, and processing invoices in an electronic format. This method of invoicing has become increasingly popular in recent years due to the many benefits it offers over traditional paper-based invoicing. E invoicing is the electronic transmission of invoices between businesses. It is a process that enables businesses to send and receive invoices electronically, rather than through the mail. This can save businesses time and money, as it eliminates the need to print and mail invoices. This can include PDFs, XML files, or other electronic formats. E-invoicing can be done via online portals, or integrated into accounting software. It is becoming increasingly popular as it can save time and money compared to traditional paper invoicing, and it can also improve accuracy and security.

How does e-Invoicing work?

E invoicing works by creating a digital invoice that is sent electronically from one business to another. This invoice can be in the form of a PDF, an Excel spreadsheet, or a Word document. Once the invoice is received, it can be processed and paid electronically.

E-invoicing, also known as electronic invoicing, is a process where invoices are created, sent, and received electronically instead of on paper. It involves the use of digital technologies such as email, file transfer protocols (FTP), and electronic data interchange (EDI) to transmit invoices between businesses and their customers.

1.Creation of the Invoice: The invoice is created using accounting software or an e-invoicing platform. It includes all the necessary information such as the invoice number, date, items or services purchased, and the total amount due.

2.Sending the Invoice: The invoice is then sent electronically to the customer. This can be done via email, FTP, or EDI.

3.Receiving the Invoice: The customer receives the invoice electronically and can view it on their computer or mobile device. They can also download and save the invoice for their records.

4.Payment: The customer can then make the payment electronically, using a credit or debit card, or through an electronic funds transfer (EFT).

5.Confirmation: The invoice is marked as paid, and both the customer and the business receive a confirmation of the payment.

E-invoicing can help businesses save time and money by reducing the cost of printing and mailing paper invoices. It can also improve the accuracy and speed of invoicing and payments, leading to better cash flow management.

What is e-Invocing under GST?

The term 'e-Invocing' is used in the context of the Goods and Services Tax (GST) to denote the process of issuing an invoice for supplies made through the use of Information and Communication Technology (ICT) tools such as the internet, email, or SMS. Under GST, an e-invoice is a legal document that serves as an invoice for supplies made through ICT tools. It must include the necessary information required under the GST law, such as the supplier's name, GST registration number, contact details, description of the goods or services supplied, and the price. The use of e-invoices is encouraged under GST as it helps to reduce the administrative burden on businesses, and also helps to ensure the accuracy and integrity of invoicing data.

e-Invoicing under GST is a system of generating and transmitting invoices electronically in a specified format, as mandated by the GST Council. It is aimed at reducing compliance costs for businesses and improving the efficiency of tax administration. Under the e-invoicing system, businesses are required to generate invoices in a specified format and transmit them to the GST Network (GSTN) through a GST Suvidha Provider (GSP). The invoice information is then made available to the relevant tax authorities for verification and assessment.

Under the Goods and Services Tax (GST) regime in India, e-Invoicing is a mandatory system for certain businesses to follow. This system enables real-time validation and verification of invoices, and helps to ensure compliance with GST laws and regulations. The e-Invoicing system is integrated with the GST system and enables businesses to generate a unique invoice reference number (IRN) and a QR code for each invoice, which can be used to authenticate and validate the invoice.

What are the benefits of e-invoicing?

There are many benefits of e invoicing, including:

• Increased efficiency – E invoicing can speed up the invoicing process, as businesses can send and receive invoices electronically.

• Reduced costs – E invoicing can save businesses money, as it eliminates the need to print and mail invoices.

• Improved accuracy – E invoicing can help to improve the accuracy of invoices, as there is less chance of them being misplaced or lost in the mail.

• Greater visibility – E invoicing can give businesses greater visibility into their invoicing process, as they can track the status of invoices and payments online.

• Environment Friendly – E-invoicing reduces the need for paper and ink, which can help reduce a company's environmental impact.

Who must create e invoice and its appliciablity?

Businesses or individuals that provide goods or services to other businesses or individuals must generate an invoice. This includes companies, self-employed individuals, freelancers, and any other entity that sells products or offers services to customers.

The entity responsible for creating and implementing e-invoicing will depend on the specific circumstances and requirements of the business or organization. In general, it is typically the finance or accounting department that is responsible for creating and issuing invoices. However, the implementation of e-invoicing systems and processes may involve collaboration between different departments and stakeholders, such as IT, procurement, and sales. Ultimately, the responsibility for e-invoicing will depend on the specific policies and procedures of the organization.

Turnover criteria refers to the annual sales or revenue threshold that a business must meet in order to be required to comply with certain regulations or laws, such as electronic invoicing. An e-invoice limit, on the other hand, refers to the maximum amount of a transaction for which an electronic invoice is mandatory. The specific turnover criteria and e-invoice limits can vary depending on the country and industry.

Is e-Invoicing mandatory?

Invoicing is mandatory in most countries as it is a legal requirement for businesses to issue invoices to customers for goods and services provided. Invoicing serves as proof of transaction and is used for tax and accounting purposes. It is also important for businesses to keep accurate records of their financial transactions for compliance with government regulations and for their own financial management.

An e-invoice typically includes the following mandatory fields:

1.Invoice number

2.Invoice date

3.Seller/Supplier information (name, address, tax identification number)

4.Buyer/Customer information (name, address, tax identification number)

5.Total amount of the invoice

6.Tax amount (if applicable)

7.Payment terms and due date

8. A unique identification number that is specific to the e-invoice system being used.

How can businesses get started with e invoicing?

Businesses can get started with e invoicing by signing up for an e invoicing service. There are many e invoicing providers available, and most offer free trials so businesses can test out the service. Once a business has signed up for an e invoicing service, they will need to create digital invoices that can be sent electronically to their customers.

1.Research e-invoicing platforms: Look for e-invoicing platforms that are compatible with your accounting software and that have features that align with your business needs.

2.Set up an e-invoicing system: Once you have chosen a platform, set up your e-invoicing system by creating an account, linking it to your accounting software, and configuring your settings.

3.Test the system: Before you start sending e-invoices, test the system by sending a few invoices to yourself or a colleague to ensure that it is working properly.

4.Communicate with your customers: Let your customers know that you will be switching to e-invoicing and provide them with instructions on how to access and pay their invoices.

5.Implement a process for e-invoicing: Establish a process for sending, receiving, and tracking e-invoices, including how to handle disputes or errors.

6.Continuously monitor and improve: Monitor the system to ensure it is working efficiently and make any necessary improvements to ensure a smooth e-invoicing process.

Who need not comply with e-Invoicing?

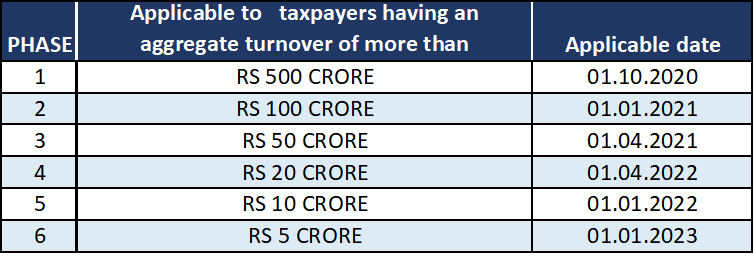

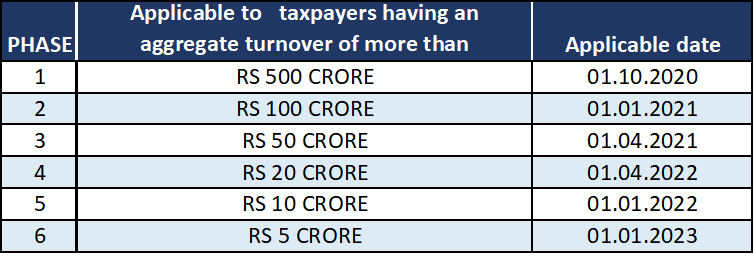

The Goods and Service Tax Council has made it compulsory for businesses with a periodic development of over ₹ 5 crore to move to e-invoicing in the coming time.Similar, businesses will have to induce electronic checks for business- to- business( B2B) deals starting January 1, 2023, reported the Economic Times quoting a government functionary familiar with the matter.

Earlier, businesses having of ₹ 20 crore and over were needed to introduce-invoices for all B2B deals.The Central Board of Indirect levies and Customs( CBIC) had reduced e-invoice threshold to ₹ 10 crore or further. Now, it has been further lowered to ₹ 5 crore.The GST Council had before decided to apply-invoicing in a phased manner.The recent move to lower the periodic development limit for-invoicing to ₹ 5 crore is aimed at ultimately bringing all businesses with over ₹ 1 crore development under the frame.This will help bring small businesses under the formal frugality, draw profit leakages, and insure compliance, the government functionary told ET.The government rolled out e-invoicing system on October 1, 2020. originally, companies with development of over ₹ 500 crore were needed to introduce-invoices as per the Goods and Services Tax( GST) guidelines.It was also extended to include businesses with over ₹ 100 crore periodic development from January 1, 2021, and also to companies with further than ₹ 50 crore development from April last time.

In e-invoicing system, the Invoice Registration Portal( IRP) is issued an identification number for every tab generated.The checks are authenticated electronically by GSTN, and the information is transferred to both e-way bill portal and GST gate in real time. This eliminates the need to manually enter data while filing a GSTR- 1 return and reduces mismatch crimes.

When it comes to e invoicing, there are a few different ways businesses can get started. One way is to use a cloud-based e invoicing service. This type of service allows businesses to create and send invoices online, and typically includes features like tracking payments and generating reports.

Another option is to use an e invoicing software program that is installed on the business's computer. This type of software typically offers more customization options, but also requires more setup and maintenance.

Regardless of which type of e invoicing service or software the business chooses, there are a few key things to keep in mind. First, make sure the service or software can integrate with the business's accounting software. This will make it easier to track payments and generate reports.

Also, be sure to test out the service or software before committing to it. This will help ensure that it is compatible with the business's needs and that it is easy to use.

How can e-Invoicing curb tax evasion?

E-invoicing can curb tax evasion by providing real-time data and tracking of transactions, making it more difficult for businesses to underreport or misreport their income. Additionally, e-invoicing can increase transparency and accountability by allowing government tax agencies to easily access and verify invoice data, making it easier to detect and investigate potential tax evasion. E-invoicing can also improve compliance by automating the process of generating and submitting invoices, reducing the chance of errors or omissions. Overall, e-invoicing can help create a more efficient and effective system for collecting taxes, reducing the incentive for businesses to evade taxes.

E-invoicing is an invoicing process that is conducted electronically. This process can help curb tax evasion as it leaves a paper trail that can be tracked and monitored. Additionally, e-invoicing can help businesses save time and money, as it is an efficient and cost-effective way to conduct transactions.

How does Clear e-Invoicing help?

Clear e-Invoicing helps organizations streamline their invoice processing by eliminating the need for paper invoices and manual data entry. Instead, invoices are sent and received electronically, which can save time and reduce errors. Additionally, e-invoicing can also improve visibility and tracking of invoices, as well as facilitate easier compliance with tax and accounting regulations.

There are many benefits of using clear e invoicing. One of the biggest advantages is that it can help reduce costs.

With clear e invoicing, businesses can save on postage and paper costs, as well as the time it takes to process invoices. This is because the invoices are sent and received electronically, eliminating the need for paper copies.Another advantage of clear e invoicing is that it can help businesses improve their cash flow. This is because the invoices are processed more quickly, allowing businesses to receive payment sooner. In addition, businesses can track their invoices more easily with clear e invoicing, which can help them identify any late payments.Finally, clear e invoicing can help businesses improve their environmental sustainability. This is because it eliminates the need for paper invoices, which can create a lot of waste.

What is Systems before and after e-invoicing?

Before e-invoicing, companies typically used paper-based invoicing systems. This involved manually creating invoices, mailing them to customers, and manually entering payment information into accounting systems. This process was time-consuming, prone to errors, and often resulted in delayed payments.

After e-invoicing, companies have switched to electronic invoicing systems. This involves creating and sending invoices electronically, and receiving and processing payments electronically. E-invoicing systems are faster, more efficient, and less prone to errors than paper-based systems. They also allow for real-time tracking and reporting of invoices and payments, and can integrate with accounting systems for automated data entry. Overall, e-invoicing can save companies time and money, and improve the accuracy and efficiency of their invoicing and payments processes.

Systems before e-invoicing were often slow, paper-based, and prone to human error. This resulted in significant wasted time and money, as well as frustration for businesses and customers alike.E-invoicing is a system that allows businesses to send and receive invoices electronically. This system is faster, more accurate, and more efficient than traditional paper-based invoicing.E-invoicing helps businesses save time and money by reducing the amount of paperwork that is required. It also eliminates the need to print and mail invoices. This system is more accurate than traditional invoicing, because it eliminates the possibility of human error.E-invoicing is also more efficient than traditional invoicing, because it allows businesses to send and receive invoices electronically. This system eliminates the need to fax or mail invoices, which can be slow and inefficient.