What is TReDS?

The Trade Receivable Discounting System (TReDS) is an electronic platform that allows businesses to sell their outstanding invoices to financial institutions. TReDS participants include banks, non-banking financial companies (NBFCs), and invoice discounters. The TReDS platform was launched in March 2015 by the Reserve Bank of India (RBI) and is aimed at improving liquidity for small businesses. The platform allows businesses to sell their invoices at a discount to financial institutions, which in turn can use the invoices as collateral to obtain financing. Trade receivable discounting system (TReDS) is an electronic system that allows businesses to sell their receivables to financial institutions in order to obtain liquidity. The system is designed to help businesses manage their cash flow and improve their working capital position.The TReDS system is a web-based application that allows businesses to submit information about their receivables, including the customer name and contact information, invoice number, and amount owed. Financial institutions then review the information and decide whether or not to purchase the receivables.If a financial institution decides to purchase the receivables, it will send the business a purchase agreement. The business then signs the agreement and sends it back to the financial institution. The financial institution then wires the money to the business's bank account.The TReDS system is designed to help businesses improve their working capital position by providing them with liquidity. The system also helps businesses improve their cash flow by allowing them to sell their receivables at a discount.

How does TReDS work?

Businesses that wish to use the TReDS platform must first register with the RBI. Once registered, businesses can upload invoices on the platform. Financial institutions can then bid on the invoices, and the business will receive the best offer. The financial institution that buys the invoice will then collect the payment from the customer. A trade receivable discounting system, also known as TReDS, is a financial system that allows businesses to sell their outstanding invoices at a discount. This system is beneficial to both the buyer and the seller of the invoice. The buyer is able to get a discount on the invoice, and the seller is able to receive payment for the invoice sooner than if the invoice were to be paid in full.The trade receivable discounting system is a fairly new system, having been introduced in 2007. The system is managed by three companies: The Bill & Melinda Gates Foundation, The MasterCard Foundation, and the Consultative Group to Assist the Poor. The system is used in over 30 countries, and is growing rapidly.The trade receivable discounting system is used by businesses to finance their working capital needs. The system allows businesses to sell their outstanding invoices at a discount. The buyer is able to get a discount on the invoice, and the seller is able to receive payment for the invoice sooner than if the invoice were to be paid in full.

What are the benefits of TReDS?

The TReDS platform has several benefits for businesses, financial institutions, and consumers.For businesses, the TReDS platform allows them to obtain liquidity by selling their outstanding invoices. This can help businesses to meet their working capital needs and improve their cash flow. For financial institutions, the TReDS platform allows them to obtain financing by using outstanding invoices as collateral. This can help financial institutions to expand their lending portfolio and provide financing to small businesses. For consumers, the TReDS platform allows them to obtain goods and services from businesses by paying for them through invoices. This can help consumers to get goods and services at a discount.

1. TReDS can help businesses to improve their cash flow by providing access to funds quickly and easily. This can be particularly useful for small businesses that may not have the credit history or collateral to secure a loan from a traditional lender.

2. TReDS can also be a more cost-effective way to borrow money than traditional loans.

3. TReDS can help businesses to improve their credit rating, as it demonstrates that they are able to manage and repay debt.

4. TReDS can also be used as a tool to manage and collect outstanding invoices. This can help businesses to improve their cash flow and reduce the amount of money they are owed.

How is TReDS different from other financing options?

The TReDS platform is different from other financing options because it allows businesses to sell their outstanding invoices to financial institutions.This allows businesses to obtain liquidity and financial institutions to obtain financing.

When it comes to financing a business, there are a multitude of options available. Each option has its own set of pros and cons, and it can be difficult to decide which option is best for your business. In this article, we will compare and contrast two popular financing options: debt financing and equity financing.Debt financing is the process of borrowing money from a lender in order to finance a business. This type of financing is typically used by businesses that have a good credit history and can afford to make monthly payments on the debt. The advantage of debt financing is that the interest rates are typically lower than those associated with equity financing. Additionally, the lender will have a stake in the business in the event of a default, which can be helpful in terms of recovering some of the money that was lent.Equity financing is the process of selling shares in a business in order to finance its operations. This type of financing is typically used by businesses that are in the early stages of development and do not have a good credit history. The advantage of equity financing is that the interest rates are typically lower than those associated with debt financing. Additionally, the business owner retains full ownership of the company and is not subject to the risk of default.Ultimately, the type of financing that is best for your business will depend on a variety of factors, including the amount of money that you need, the credit history of your business, and the amount of risk that you are willing to take.

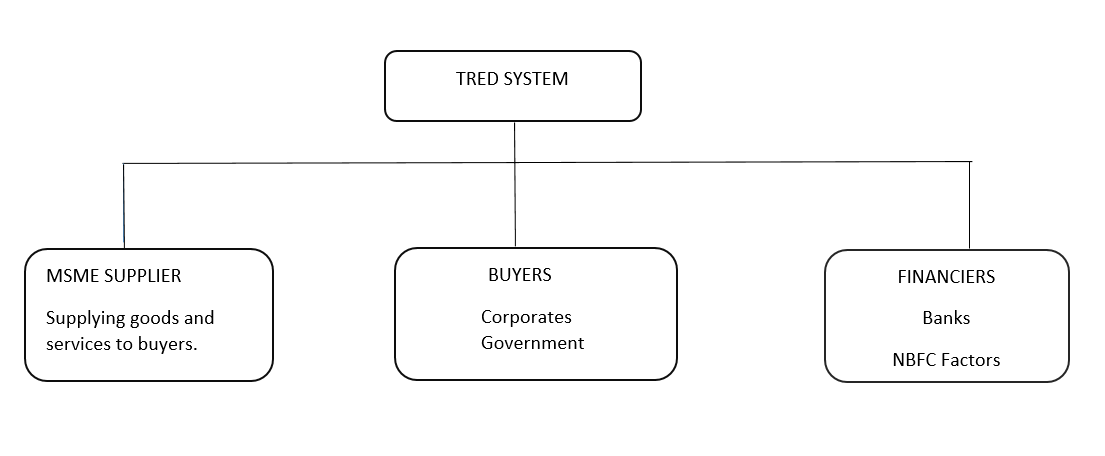

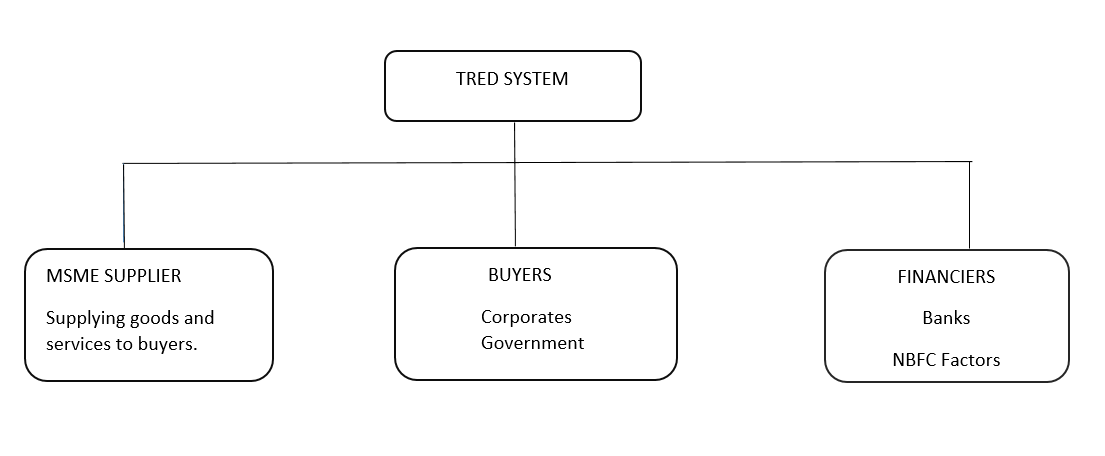

PARTICIPANTS IN TREDS SYSTEM

The TReDS system is a trade receivables discounting system that allows for the financing of receivables through the sale of discounted notes. The system is available to a wide range of businesses, including those in the manufacturing, services, and agriculture sectors. The TReDS system is also available to state and local government entities.

WORKING MECHANISM OF TReDS

The TReDS system is a mechanism for the secure and efficient transmission of trade data between businesses. The system is designed to allow businesses to share data with each other in a secure and efficient manner, thus reducing the need for manual input and improving the accuracy of data.The TReDS system is based on a distributed ledger technology, which allows businesses to share data without the need for a third party. The ledger is tamper-proof, meaning that the data cannot be changed or edited without being detected. This ensures the accuracy of the data and prevents fraud.The TReDS system is also based on blockchain technology, which is a distributed database that allows businesses to share data without the need for a third party. The blockchain is tamper-proof and secure, meaning that the data cannot be changed or edited without being detected. This ensures the accuracy of the data and prevents fraud.The TReDS system is designed to be user-friendly and easy to use. Businesses can access the system through a web-based portal, and can share data with each other in a secure and efficient manner. The TReDS system is a working mechanism that allows businesses to exchange credits and debts electronically. This system helps to improve the liquidity of businesses and helps to improve the flow of money. The TReDS system is made up of three parts: the Trade Receivables Exchange, the Treasury Management System, and the Debt Collection System.

The Trade Receivables Exchange is the part of the system that allows businesses to exchange credits and debts. The Treasury Management System is the part of the system that allows businesses to manage their money. The Debt Collection System is the part of the system that allows businesses to collect money that is owed to them.The Trade Receivables Exchange is the part of the system that allows businesses to exchange credits and debts. The Trade Receivables Exchange is a place where businesses can go to sell their credits and debts. The Treasury Management System is the part of the system that allows businesses to manage their money. The Treasury Management System is a place where businesses can go to buy credits and debts. The Debt Collection System is the part of the system that allows businesses to collect money that is owed to them. The Debt Collection System is a place where businesses can go to get money that is owed to them.The Trade Receivables Exchange is the part of the system that allows businesses to exchange credits and debts. The Trade Receivables Exchange is a place where businesses can go to sell their credits and debts. The Treasury Management System is the part of the system that allows businesses to manage their money. The Treasury Management System is a place where businesses can go to buy credits and debts. The Debt Collection System is the part of the system that allows businesses to collect money that is owed to them. The Debt Collection System is a place where businesses can go to get money that is owed to them.

When a company needs to finance a purchase, it will often turn to a discounting company like TReDS to get the best rate. TReDS is a platform that connects companies that need to finance a purchase with a group of banks that are willing to provide financing. TReDS works by acting as an intermediary between the buyer and the banks. The buyer submits a request for financing and TReDS sends the request to a group of banks. The banks then submit their best offer to TReDS. TReDS then selects the best offer and sends it to the buyer.

The steps that take place during financing / discounting through TReDS are:

1. The buyer submits a request for financing to TReDS.

2. TReDS sends the request to a group of banks.

3. The banks submit their best offer to TReDS.

4. TReDS selects the best offer and sends it to the buyer.

TREDS PLATFORM PROVIDERS

The TReDS platform providers in the country are the backbone of the economy. They provide a platform for businesses to trade receivables and make it easier for them to manage their cash flow.Some of the TReDS platform providers in the country include Reliance Commercial Finance, invoicexpress, Capital Float, and Lendingkart. They offer a wide range of services to businesses of all sizes.The TReDS platform providers are constantly innovating and expanding their services. They are providing a variety of financing options to businesses, such as invoice financing, line of credit, and term loans.They are also offering innovative products, such as purchase order financing and trade finance. This is helping businesses to grow and expand their operations.The TReDS platform providers are also helping businesses to reduce their costs. They are providing a platform for businesses to trade receivables at a discount. This is helping businesses to improve their cash flow and reduce their costs.The TReDS platform providers are playing a crucial role in the economy. They are helping businesses to grow and expand their operations. They are also helping businesses to reduce their costs. This is making them an integral part of the economy.

Process flow and procedure

Once registered on one of the three TReDS platforms, here’s how the process flow works, supported by RBI data:

1.A purchase order is sent to the seller by the corporatebuyer.

2. The goods are delivered and an invoice is generated. The bill of exchange between the buyer and seller may or may not beaccepted.

3. The buyer logs on to the TReDS platform and accepts the factoring unit created on the invoice or bill of exchange.

4 The standard time window for corporate buyers to ‘accept the units will be based on the invoice or bill of exchange.

5. The seller of Micro, Small and Medium-sized Businesses may decide to use the TReDS platform to upload documents supporting evidence of the movement of goods.

6. There will be separate modules for transactions with invoices and Bills of Exchange.

7. Factoring units can be created in each module. The sanctity and enforceability of each unit will be the same as allowed for physical instruments under either the Factoring Regulation Act or the Negotiable Instruments Act.

8. The features and format of thefactoring unit will be decided by the TReDS platform. Each unit will represent an obligation from the buyer to pay Information of the seller and buyer will be included in the unit.

9. The TReDS platforms should be able to detect these units. Flexibility of operations is provided by this.

10. Once the factoring unit and all the details have been generated, a notice or advice is automatically sent to the buyer's bank.

11. These units can be financed or bid on by any of the financiers registered on the TReDS platform. The final amount quoted by the financier can only be seen by the seller of the Micro, Small and.Medium-sized business.

12. There will be a window period for financiers to quote these bids. The financiers can choose how long their bids are valid.

13. The MSME accepts any bid. The financier is notified that their bid has been accepted.

14. Once a bid is accepted by the seller, financiers can't change it.

15. The funds will be deposited in the seller's account by the financier two business days after the date of the article. The company's secretary accepted. TReDS platforms have the option to speed up the time taken for payment. Micro businesses on the M1xchange platform receive payment inT+1.

16. The corporate buyer transfers the due amount to the financier on the due date. Due notifications are sent to corporate buyers and their banks by the TReDS platform.

17. If the buyer doesn't pay on the due date,the bankers will be able to proceed against the corporate buyer.

18. Any action in this regard will be non-recourse with respect to the sellers.

19. After financing, these instruments are rated by the TReDS platform and may be further transacted or discounted among financiers in the secondary segment.

20.A direct debit authority will be enabled by the buyer's bank if a successful trade is made in the secondary segment.

21. If a factoring unit is unfinanced, the buyer corporate will pay the seller outside of the TReDS platform.

REGULATORY FRAMEWORK

The regulatory framework of Treds is based on the French system of regulation of securities. The regulatory framework of Treds is based on the following principles:

The principle of proportionality, which provides that the regulatory measures must be appropriate to the objectives pursued and the risks to which they are exposed.The principle of legality, which requires that regulatory measures must be based on a legal basis.The principle of publicity, which requires that regulatory measures must be made public.The principle of subsidiarity, which provides that the regulatory authority must intervene only when the public interest so requires and at the lowest level of intervention.The regulatory framework of Treds is based on the French system of regulation of securities. The regulatory framework of Treds is based on the following principles:The principle of proportionality, which provides that the regulatory measures must be appropriate to the objectives pursued and the risks to which they are exposed.The principle of legality, which requires that regulatory measures must be based on a legal basis.The principle of publicity, which requires that regulatory measures must be made public.The principle of subsidiarity, which provides that the regulatory authority must intervene only when the public interest so requires and at the lowest level of intervention.

CONCLUSION

In general, we believe that treds can be a very helpful tool for businesses and entrepreneurs. They can help to streamline operations, save time, and increase efficiency. However, there are some things to keep in mind when using treds.First, make sure that you are using the right treds for the job. Not all treds are created equal, and not all treds will be appropriate for your specific needs.Second, make sure that you are using the treds correctly. If you don't use them correctly, they can actually be more of a hindrance than a help.Finally, make sure that you are using the treds to supplement your existing operations, not to replace them. Treds should be used to make your business more efficient, not to do the work for you.Overall, we believe that treds can be a very helpful tool for businesses and entrepreneurs. However, you need to use them correctly and make sure that they are appropriate for your specific needs.