In recent years, India's Goods and Services Tax (GST) system has undergone significant advancements to streamline compliance processes for businesses. One such game-changer is the Invoice Management System (IMS), designed to empower taxpayers with greater control over their invoices and streamline the process of availing Input Tax Credit (ITC). If you're a merchant using e-invoicing under the Indian GST regime, this detailed guide will walk you through everything you need to know about IMS and how it can benefit your business.

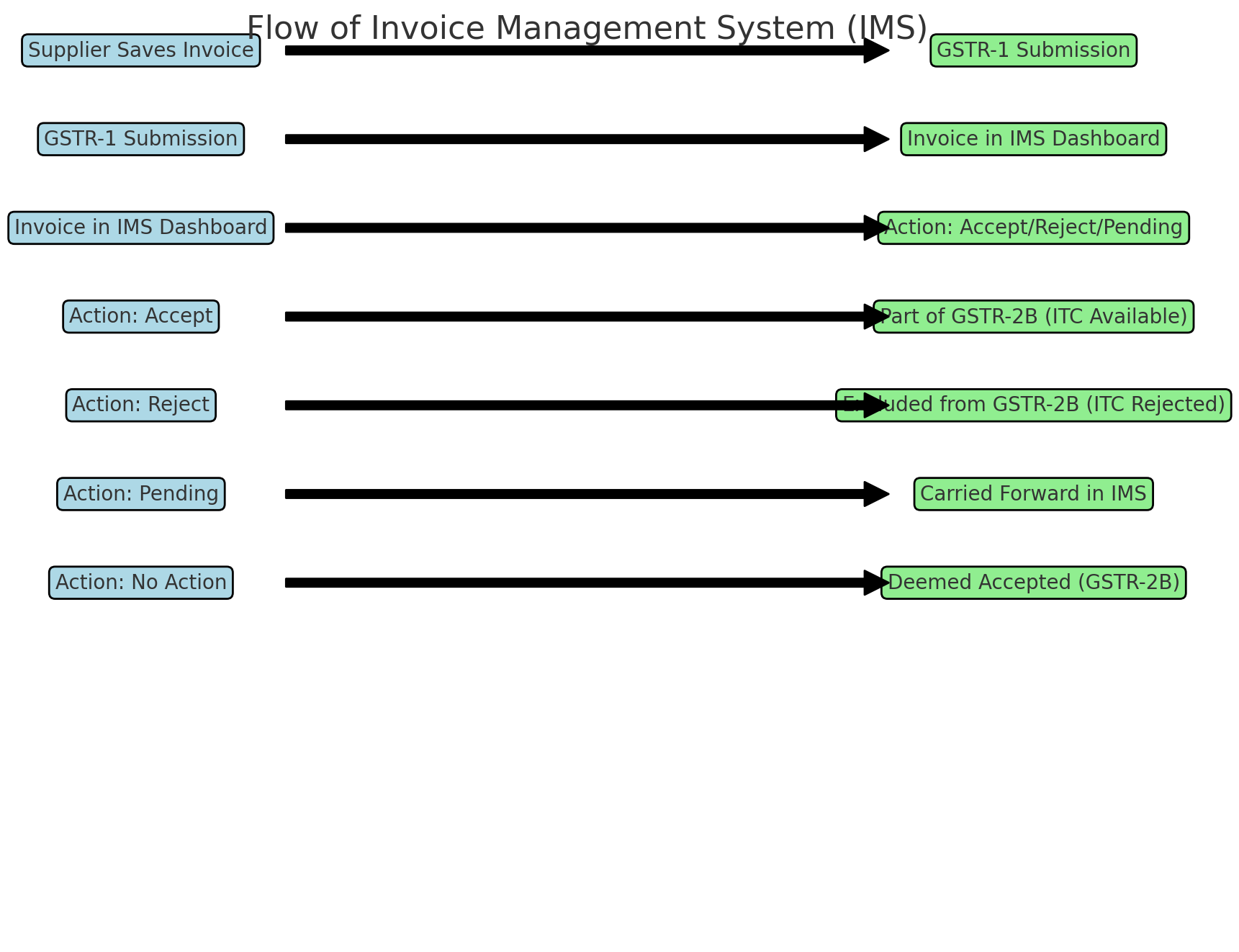

The Invoice Management System (IMS) is a revolutionary facility introduced by the GST Common Portal. It enables businesses to accept, reject, or keep pending the invoices uploaded by their suppliers on the GST platform. This system is crucial for merchants to manage their Input Tax Credit (ITC) effectively by ensuring only valid and correct invoices are accepted.

Starting from 1st October 2024, IMS is available for all registered taxpayers. Merchants can take action on their received invoices from 14th October 2024 onwards(draft_manual_ims)(revised_advisory_on_ims).

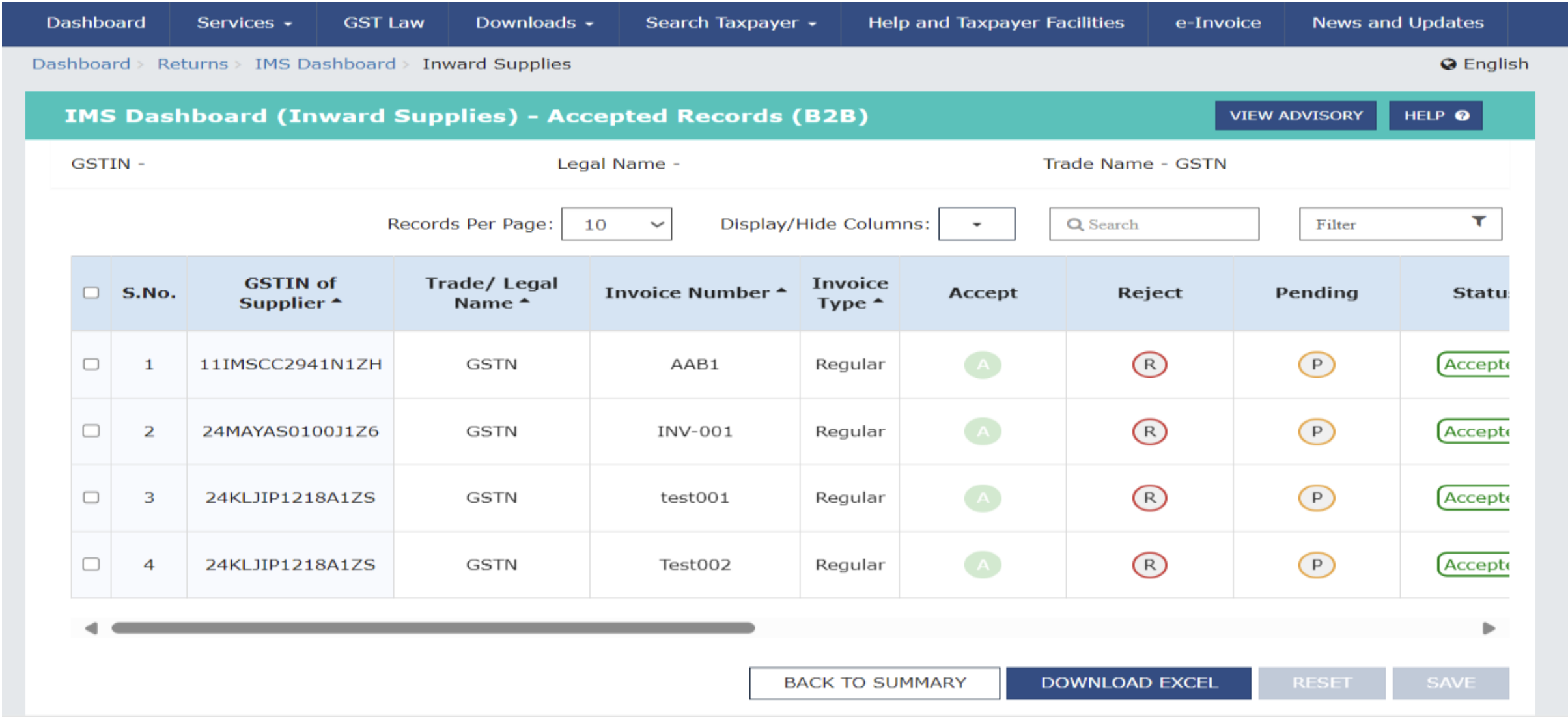

Merchants can access the IMS through the GST Portal by navigating to:

Dashboard > Services > Returns > Invoice Management System (IMS)(final_faqs_on_ims_22_09…).

Login to the GST Portal: Head over to GST.gov.in, log in with your credentials, and click on the IMS option under the ‘Returns’ tab(draft_manual_ims).

IMS Dashboard: The dashboard presents two sections:

Inward Supplies Management:

Invoice Actions:

Bulk Actions: You can select multiple invoices and take bulk actions using checkboxes and bulk action buttons(draft_manual_ims).

Download and Excel Export: Download your entire invoice list in Excel format for offline review and analysis(draft_manual_ims).

Streamlined ITC Management: IMS offers a clear and efficient method to ensure that only eligible invoices are included in your ITC claims. This reduces errors and minimizes the risk of penalties due to incorrect claims(revised_advisory_on_ims).

Real-time Invoice Visibility: Merchants can view and take action on invoices as soon as they are uploaded by suppliers, ensuring transparency in transactions(revised_advisory_on_ims).

Reconciliation of Records: IMS simplifies the reconciliation process by allowing merchants to match their records with those submitted by their suppliers, further ensuring accuracy in GST filings(draft_manual_ims)(revised_advisory_on_ims).

Control over Invoices: The system provides greater control over the ITC process, enabling merchants to reject incorrect invoices and keep pending invoices that need further review(revised_advisory_on_ims).

Improved GST Compliance: By providing a platform to actively manage invoices, IMS reduces the chances of errors in GSTR-2B, thereby promoting better compliance with GST laws(revised_advisory_on_ims).

1. What documents are part of IMS?

All original and amended invoices submitted by suppliers through GSTR-1, IFF, or GSTR-1A will be available in IMS. However, documents where ITC is ineligible due to POS rules or Section 16(4) of the CGST Act will not appear(final_faqs_on_ims_22_09…).

2. What happens if an invoice is rejected?

Rejected invoices are removed from GSTR-2B and excluded from ITC eligibility. The supplier needs to amend or correct the invoice in their subsequent filings(revised_advisory_on_ims)(final_faqs_on_ims_22_09…).

3. Can actions be reversed?

Yes, merchants can take multiple actions on an invoice until GSTR-3B is filed for the respective period. However, once GSTR-3B is filed, actions are frozen(final_faqs_on_ims_22_09…).

4. Is it mandatory to take action on every invoice?

No, it’s not mandatory. Invoices where no action is taken will be considered deemed accepted and included in GSTR-2B(revised_advisory_on_ims).

The Invoice Management System (IMS) is a robust tool for merchants operating under the GST regime in India, simplifying the process of invoice management, ensuring proper ITC claims, and enhancing overall GST compliance. By taking advantage of IMS, merchants can ensure smoother and more efficient business operations while adhering to GST regulations. For more details and hands-on usage, visit the GST Portal.

Download our mobile app from playstore now