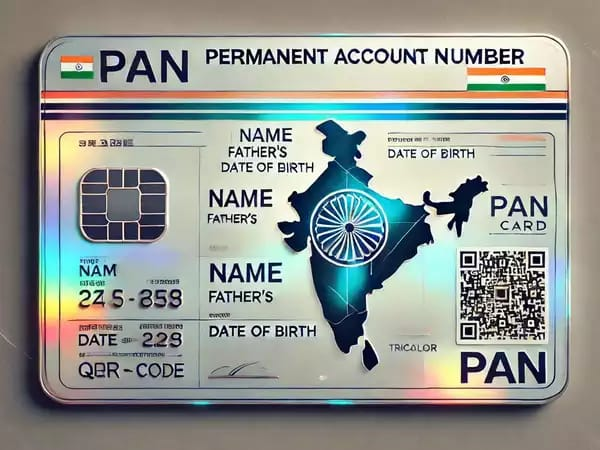

The Government of India has launched PAN 2.0, an enhanced version of the Permanent Account Number (PAN) card system, with several features aimed at improving user experience, data security, and digital accessibility. This upgrade is a step forward in achieving the vision of a paperless and eco-friendly India. Here's everything you need to know about PAN 2.0.

Dynamic QR Code:

The new PAN card features a QR code that stores the cardholder's details and is dynamically linked to the PAN database. This allows quick and secure verification and helps prevent identity theft.

Eco-Friendly Approach:

PAN 2.0 promotes paperless operations by providing e-PANs directly to the applicant's registered email. Users can download their e-PANs instantly after approval.

Free Applications and Updates:

Individuals can apply for a new PAN or update details for free, with the option to request a physical PAN card for a nominal fee.

Integrated Services:

A single portal now provides all PAN-related services, such as application submissions, updates, corrections, Aadhaar-PAN linking, and more.

Enhanced Security:

PAN 2.0 incorporates improved security features, ensuring that personal and demographic details are protected from misuse.

The eligibility criteria for applying for PAN 2.0 remain consistent with the original PAN system. Individuals, businesses, and entities that are eligible for a PAN under the Income Tax Act, 1961, can apply for PAN 2.0.

| Feature | Old PAN | New PAN (PAN 2.0) |

|---|---|---|

| QR Code | Static QR code with limited details | Dynamic QR code linked to live PAN database |

| Application Process | Physical and online modes | Entirely paperless and streamlined online |

| Cost | Charges for issuing or updating details | Free of cost (for e-PAN), nominal fee for card |

| Eco-Friendliness | Physical cards issued | e-PANs to minimize paper usage |

| Security Features | Basic security features | Enhanced with dynamic QR and encrypted data |

| Address Update | Required additional documents | Automatic via Aadhaar linking |

Applying for PAN 2.0 is simple and user-friendly. Follow these steps:

1.Determine the Issuing Agency:

2.Fill Out the Application Form:

Enter your details, including PAN, Aadhaar number (for individuals), and date of birth.

3.Complete Verification:

Verify your identity using the OTP sent to your registered mobile number or email address.

4.Download Your e-PAN:

After verification, your e-PAN will be sent to your registered email and can be downloaded immediately.

5.Request for Physical Card (Optional):

If you prefer a physical card, you can request it for Rs. 50 (domestic delivery).

With PAN 2.0, you can update your address seamlessly:

Existing PAN cards remain valid, and there is no compulsion to switch to PAN 2.0. However, upgrading to PAN 2.0 is recommended to benefit from the enhanced features such as the dynamic QR code and improved data security.

1. Is it mandatory to switch to PAN 2.0?

No, it’s not mandatory, but it is highly recommended for improved security and convenience.

2. How long does it take to receive an e-PAN?

Once your application is verified, the e-PAN is issued within minutes.

3. What is the cost of getting a physical PAN card?

A nominal fee of Rs. 50 is charged for physical card delivery within India.

4. Can I use PAN 2.0 for all transactions where a PAN is required?

Yes, PAN 2.0 is fully compatible with all transactions requiring a PAN.

Conclusion

PAN 2.0 is a game-changing initiative that aligns with India’s Digital India vision. Its enhanced features, eco-friendly approach, and improved user experience make it a valuable upgrade. Whether you’re a new applicant or an existing PAN holder, transitioning to PAN 2.0 ensures you stay ahead in a secure and efficient tax system.

By embracing PAN 2.0, taxpayers can enjoy a seamless, secure, and sustainable experience while contributing to a more transparent financial ecosystem.

Download our mobile app from playstore now